A positive NPV suggests that an investment will be profitable while a negative NPV suggests it will incur a loss. Sam’s purchasing of the embroidery machine involves spending money today in the hopes of making more money in the future. Because the cash inflows and outflows occur in different time periods, they cannot be directly compared to each other. Instead, they must be itemized tax deduction calculator translated into a common time period using time value of money techniques. By converting all of the cash flows that will occur from a project into present value, or current dollars, the cash inflows from the project can be compared to the cash outflows. If the cash inflows exceed the cash outflows in present value terms, the project will add value and should be accepted.

Cash Flow Projections

It accounts for the fact that, as long as interest rates are positive, a dollar today is worth more than a dollar in the future. In the context of evaluating corporate securities, the net present value calculation is often called discounted cash flow (DCF) analysis. It’s the method used by Warren Buffett to compare the NPV of a company’s future DCFs with its current price. It is quite possible, although rare, for a project to have more than one IRR, or no IRR at all.

Step 1: NPV of the Initial Investment

Finally, subtract the initial investment from the sum of the present values of all cash flows to determine the NPV of the investment or project. The internal rate of return (IRR) is calculated by solving the NPV formula for the discount rate required to make NPV equal zero. This method can be used to compare projects of different time spans on the basis of their projected return rates.

Basics of Net Present Value Calculation

This is also true in the real world when the discount rate increases, the business has to put more money into the project; this increases the cost of the project. The steeper the curve, the more the project is sensitive to interest rates. So, JKL Media’s project has a positive NPV, but from a business perspective, the firm should also know what rate of return will be generated by this investment.

Example: IRR vs NPV in Capital Budgeting

- Assume the monthly cash flows are earned at the end of the month, with the first payment arriving exactly one month after the equipment has been purchased.

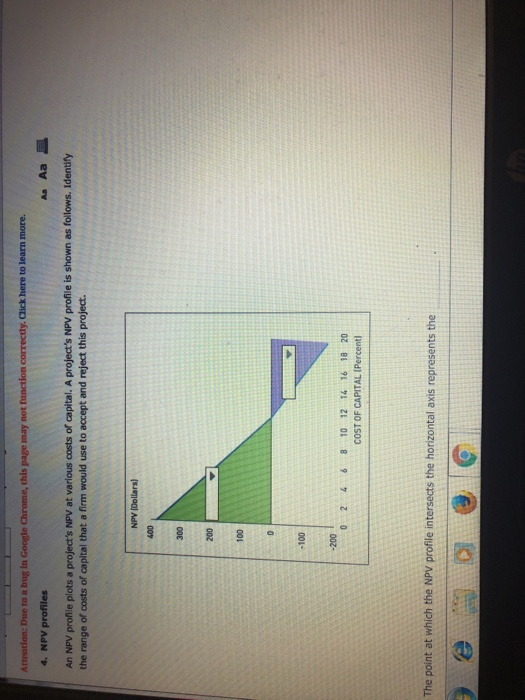

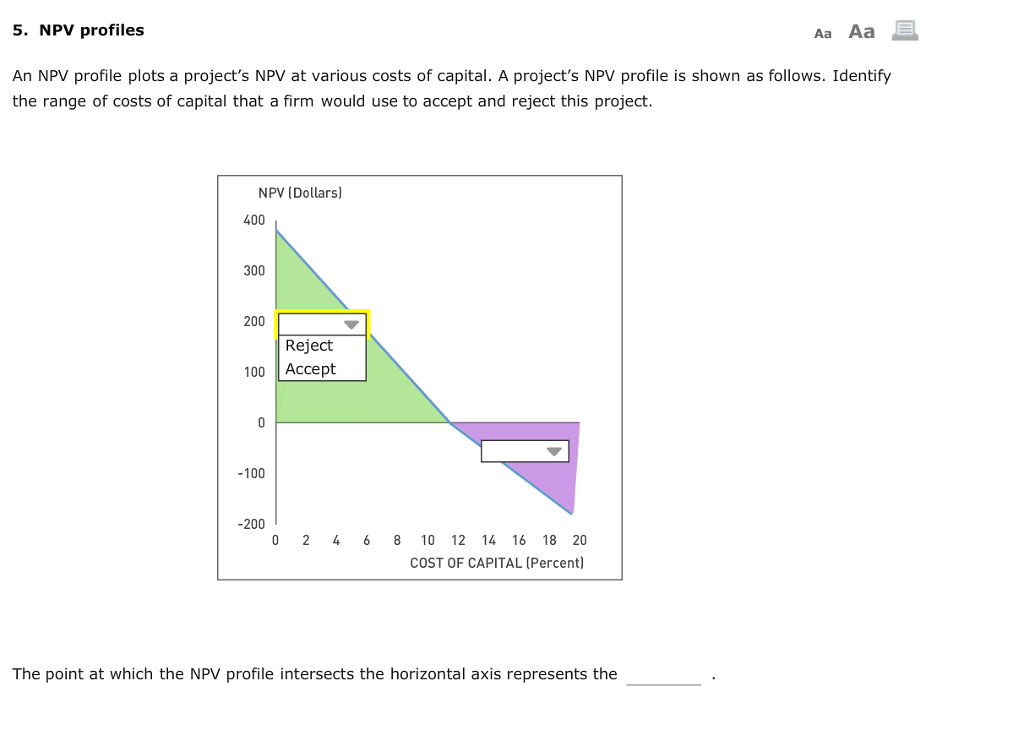

- If the cost of capital is more than 14%, however, the NPV is negative, and the company should reject the project.

- This indicates that the project may not be economically feasible and should be avoided.

- However, in the case of two mutually exclusive projects, sometimes the decision rules will draw different conclusions.

One of the most common and useful ways to measure the performance of an investment is to calculate… This is depicted in the graph where the two lines of Project A and Project B meet.

When using the NPV profile to evaluate investment projects, it is important to consider the project’s specific requirements, risk tolerance, and strategic objectives. By comparing the NPV profiles of different projects, decision-makers can prioritize investments based on their financial viability and alignment with organizational goals. The NPV profile is a graphical representation of the net present value (NPV) of an investment project at different discount rates.

To do this, the firm would simply recalculate the NPV equation, this time setting the NPV factor to zero, and solve for the now unknown discount rate. The rate that is produced by the solution is the project’s internal rate of return (IRR). NPV is sensitive to changes in the discount rate, which can significantly impact the results. Small changes in the discount rate can lead to large variations in NPV, making it challenging to determine the optimal investment or project.

Calculating NPV involves computing the present value of each cash flow and then summing the present values of all cash flows from the project. This project has six future cash flows, so six present values must be computed. It empowers decision-makers to navigate the complex landscape of investments, combining financial rigor with strategic vision. As you embark on your next project evaluation, remember that the NPV profile is more than a graph—it’s a compass guiding you toward informed choices. The shape of the NPV profile indicates the sensitivity of the project’s profitability to changes in the discount rate. A steeper upward-sloping profile suggests that the project is more sensitive to changes in the discount rate, making it riskier.

Next, all of the investment’s future positive cash flows are reduced into one present value number. Subtracting this number from the initial cash outlay required for the investment provides the net present value of the investment. The formula for calculating NPV involves taking the present value of future cash flows and subtracting the initial investment. The present value is calculated by discounting future cash flows using a discount rate that reflects the time value of money.