The value of a convertible preferred stock is ultimately based on the performance of the common stock. These dividend payments are guaranteed but not always paid out when they are due. Unpaid dividends are assigned the moniker “dividends in arrears” and must legally go to the current owner of the stock at the time of payment.

- The low par values of the preferred shares also make investing easier, because bonds (with par values around $1,000) often have minimum purchase requirements.

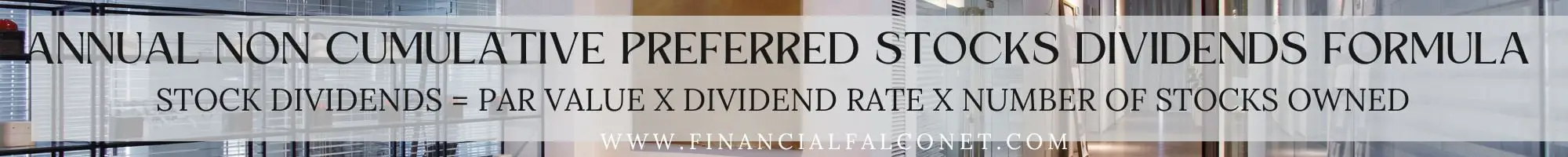

- The noncumulative preference shareholders hold no right to claim any unpaid dividends in subsequent years.

- Noncumulative Preference Stocks are the stocks that are issued by the companies, but then the issuer may skip or decide not to pay the dividends to the shareholders any longer.

- Preferred shareholders have priority over common stockholders when it comes to dividends, which generally yield more than common stock and can be paid monthly or quarterly.

- Convertible preferred stock usually has predefined guidance on how many shares of common stock it can be exchanged for.

Seeking Income with Less Volatility

On the flip side, preferred stocks trade more like bonds, and thus don’t benefit much if the company experiences massive growth. Common shareholders get voting rights, while preferred share holders typically don’t. Once the company resumes paying dividends, it must pay $1.125 per share to preferred shareholders before making any dividend payments to common shareholders. Importantly, preferred stock shares offer some privileges that are not available to those holding common stock shares. For example, preferred stockholders have a greater claim on assets in the event of a liquidation. Common stocks represent shares of ownership in a business, and investors in common stocks have voting rights in the company.

Get in Touch With a Financial Advisor

In turn, the investor would receive a $70 annual dividend, or $17.50 quarterly. Typically, this preferred stock will trade around its par value, behaving more similarly to a bond. Investors who are looking to generate income may choose to invest in this security. The most common sector that issues preferred stock is the financial sector, where preferred stock may be issued as a means to raise capital.

What are common stocks?

Additionally, in the event of bankruptcy, common shareholders are last in line to receive any remaining assets after bondholders and preferred shareholders are paid. Cumulative preferred stocks provide provisions for the payment of dividends that have been missed out and make sure that all dividends of the company are paid to the cumulative preferred shareholders. While non-cumulative preferred stocks are not entitled to receive the missed unpaid dividends, it is not reliable and involves high risk as the company can terminate or suspend the shares at any time.

Preferred stocks are often called “hybrid” securities because they possess both bond- and equity-like aspects. However, like bonds, they also pay regular interest or dividends based on the face – or par – value of the security on a monthly, quarterly or semi-annual basis. Investors are more willing to purchase cumulative preferred stock, since they have a greater likelihood of being paid dividends. Comparing preferred stock to other investment options, such as common stocks, bonds, and other income-generating assets, can help investors make informed decisions. In the event of a company’s liquidation or bankruptcy, preferred stockholders enjoy higher priority in asset distribution compared to common stockholders.

What is Cumulative Preferred Stocks?

Non-cumulative preferred stocks give the allowance to the companies to skip dividends, and it is not obliged to the stakeholders. Cumulative preferred stocks provide safety to the shareholders as it guarantees the payment of dividend. These stocks are treated as perpetuity and do not allow exercising voting rights. Cumulative preferred stocks are entitled to receive all the missed unpaid dividends. Preferreds have fixed dividends and, although they are never guaranteed, the issuer has a greater obligation to pay them.

However, preferred stock comes with the right to receive dividends prior to common stockholders and have a higher priority in getting paid back if the company goes bankrupt and is liquidated. This type of stock allows the shareholder to convert preferred stock to common stock at a preset ratio and by some predetermined date. The potential loss of missed dividends, limited protection for investors, and lower priority in liquidation are the main disadvantages of non-cumulative preferred stock. Preferred shareholders have priority over common stockholders when it comes to dividends, which generally yield more than common stock and can be paid monthly or quarterly. These dividends can be fixed or set in terms of a benchmark interest rate like the London Interbank Offered Rate (LIBOR), and are often quoted as a percentage in the issuing description.

Suffice to say, that – as with any investment – it’s critical for individual investors to understand the particular terms and features of the preferred stocks they are buying. Researching the company’s financial health, cash flow, and dividend history can provide valuable insights into the sustainability of the preferred stock’s income stream. Preferred stockholders workflowmax job and project management software receive dividends at a fixed rate, providing a predictable source of income. This feature allows investors to share in the company’s success while still benefiting from the stability of preferred stock dividends. This type of preferred stock comes with the option to convert the shares into a predetermined number of common shares at a specified conversion ratio.